Business solutions that work

We trust in the power of innovation and are committed to delivering high-quality software solutions. We believe that the go-to-market time for new business applications can be significantly shorter and that this process can be much more efficient. We are Finaps, we deliver future-proof business solutions that work.

Digital

Innovation

Continuous innovation is key, because it impacts virtually every aspect of your business operation, but what is successful today can be outdated tomorrow.

That is why our digital innovation solutions are future-proof, legacy-free and have a short time-to-market.

In addition, we provide the technology that enables our clients to rapidly launch new revenue models, allowing them to stay ahead of the competition.

Process Optimisation

There are many ways to optimise business processes. In our line of work however, the solution is always software.

Together we will create applications that will truly optimise your processes, whether they are internal or client-facing.

Our software solutions will streamline your data-driven workflows, create complex business rules, mobilise your employees and integrate everything with your existing back-end systems.

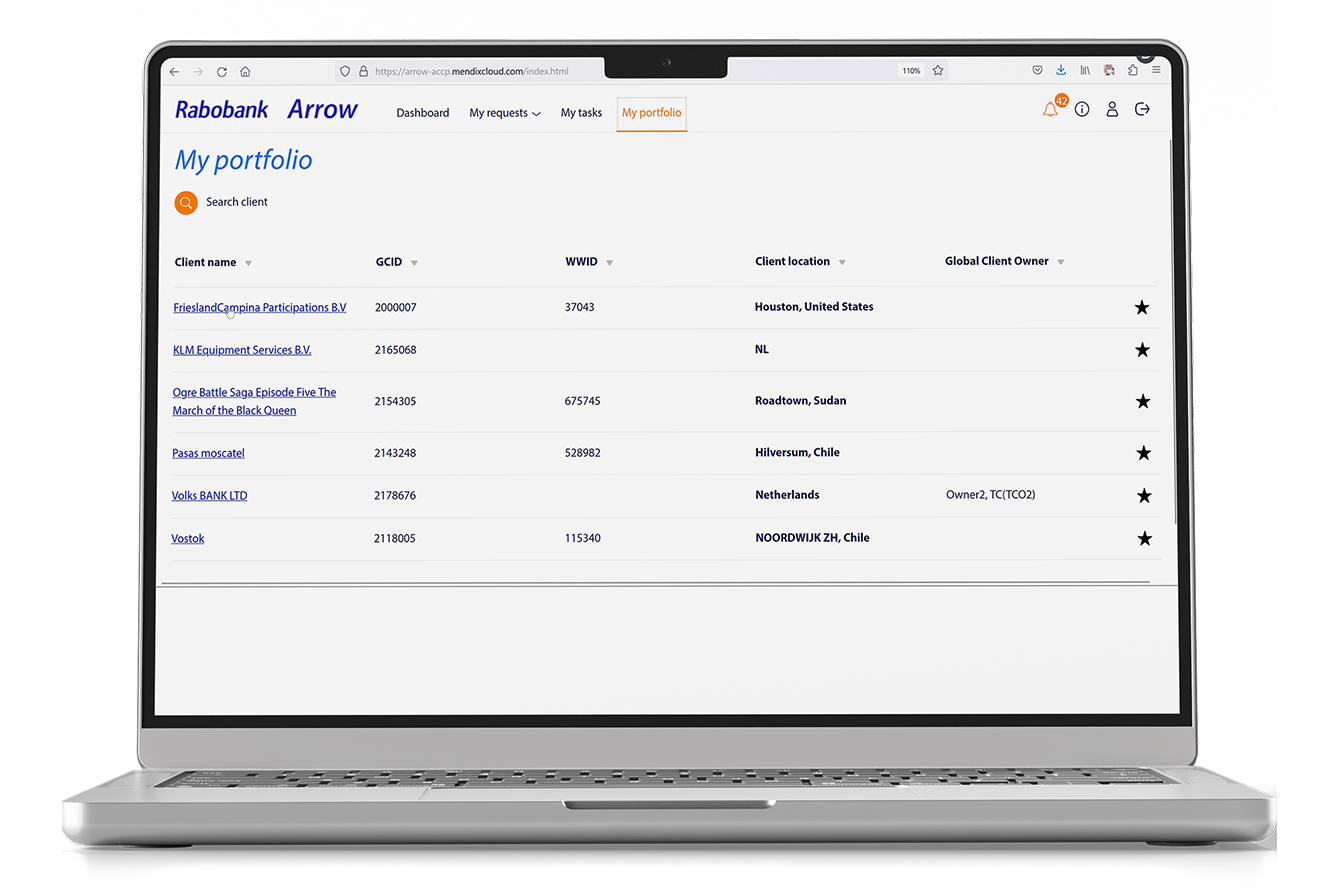

Rabobank Arrow C&E

A highly efficient workflow offering a seamless user experience in the form of a single front-end tool for the entire Credit Risk process for Rabobank’s Wholesale banking clients. This tool offers automated data capture, enabling Rabobank to realize operational efficiency; improved data quality and faster turnaround times.

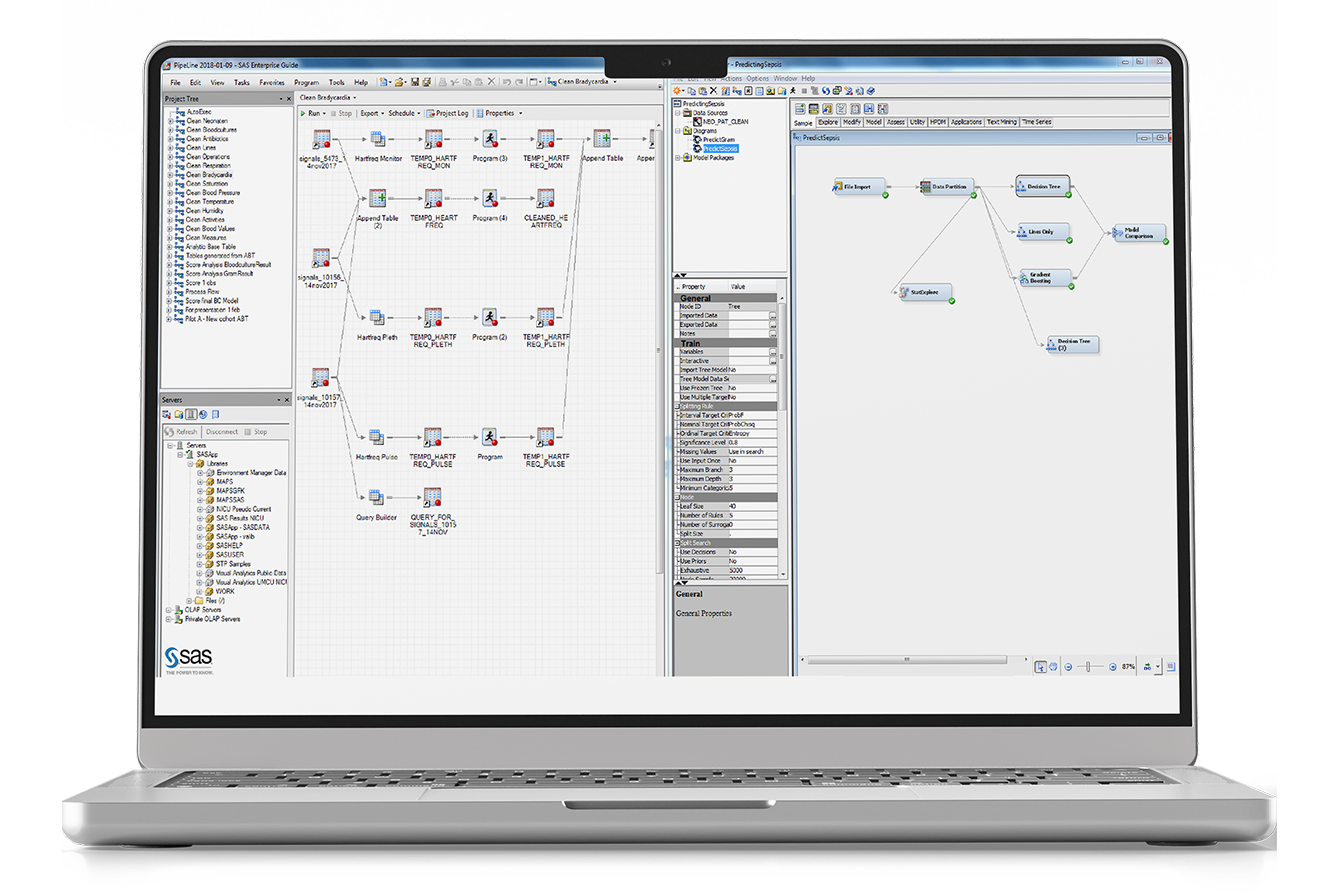

Applied

Analytics

Data is the 21st century equivalent of gold and our engineers can help you mine it.

We are able to collect, analyse and visualise your data in such a way that it can be applied in the real world, creating actual added value for your business.

Beyond mere data science, applied analytics will (actively) influence your decisions and help your business grow.

Case studies

- All cases

- Financial services

- Public Sector

- Healthcare

- Software

- Other

All cases

Working with Finaps feels like a true partnership. For me, it’s a clear example of how two parties can strengthen each other and achieve an optimal result

Daan Cuppen – Digital Transformation Manager at Allianz Trade for Multinationals

Finaps sets the engineering bar really high. Their great technical expertise and rich business skills helped us race this project through the finish line and deliver great value to our Rural business.

Rafael Nobrega – Product Manager at Rabobank

Initially, the choice was based on a personal click, whereby I noticed that Finaps, and that’s what distinguishes Finaps from other parties, clearly knows what being a bank is about and the specific challenges we face.

Irene Ronner – IT Manager International Direct Banking at Rabobank

Read case study

We have managed to get information from our data about the development of infections in newborns, and with the help of Finaps we have succeeded in making a predictive model about how these children can be treated correctly.

Dr. Daniel Vijlbrief – Neonatologist Wilhelmina Children’s Hospital

Read case study

Are you able to rely on Finaps? Is there a mutual understanding? Do they understand what Quions specific needs are? Do they do what they promised to? – They have exceeded expectations on all fronts, so I am extremely happy with our partnership with Finaps.

Robin Pol – COO Quion

Read case study

We did a market survey, and couldn’t find software that could help us. Through joining them during a Hackathon, we met Finaps. By winning this Hackathon, they showed us they could build an application in quite a short time. Together with Finaps we developed a whole new Program Management System from just a blank piece of paper. We were surprised by the speed of Finaps while developing this system.

Irivin Wekking – CTFO Terre des Hommes

Read case study

Validata Group has used Finaps and their expertise for over 9 years now and from day one there is a genuine feeling of partnership as opposed to a supplier – client relationship. Besides the fact that Finaps has the know-how to build state-of-art technology that is quick and easy to use, their true strength lies in their ability to really understand our business proposition and to translate this into strong solutions aimed at servicing the clients of Validata Group.

Harm Voogt – Co-founder Validata Group

Read case studyKnowledge hub

Wat zijn de digitale transformatietrends van 2024 binnen de verzekeringssector?

Wat zijn de belangrijkste digitale transformatie ontwikkelingen binnen de verzekeringsmarkt? Die vraag houdt Finaps’ Managing Partner Lonneke Makhija en Principal Software Engineer Kevin Pennekamp al jaren bezig. Het resulteerde in een uitgebreid E-Book waarin de belangrijkste trends en ontwikkelingen tot in detail worden gedeeld, zowel vanuit een business als een technisch aspect.

The future of banking

Like in every industry, banks can rely on one thing: change is the only constant. However, keeping up with this change in the current macroeconomic landscape is more challenging than ever. Customer expectations are rapidly evolving towards more personalized and digital banking experiences. Newcomers are entering the industry with disruptive business models powered by advanced technology to respond to these expectations. And at the same time budget restrictions, new regulations and guidelines for corporate responsibility require banks to critically look at their operations and strategy.