An online reinsurance portal that allows Arch Re Fac to quickly and easily create reinsurance programs based on their pricing structures and their clients’ unique characteristics. This provides Arch with a one-stop-shop for management and processing

Their Challenge

Creating facultative reinsurance programs involves a considerable amount of information processing based on complex rules and decision workflows. Providing external underwriters convenient access to this offering required an automated portal that verifies and quotes prices was required to. Additionally, the portal had to be flexible enough to support the ever-changing business requirements and needs of Arch Re’s clients.

A new, customisable self-service portal would be central to Arch Re Fac, as it provides underwriters and clients the information they need to draw up the reinsurance program. Therefore, Philip Augur, Chief Operations Officers at Arch Re Fac asked Finaps the question: Can you build us an online mechanism that clients can use to report risk subjects to a contract and underwriters can use to conduct pricing evaluations?

Our Solution

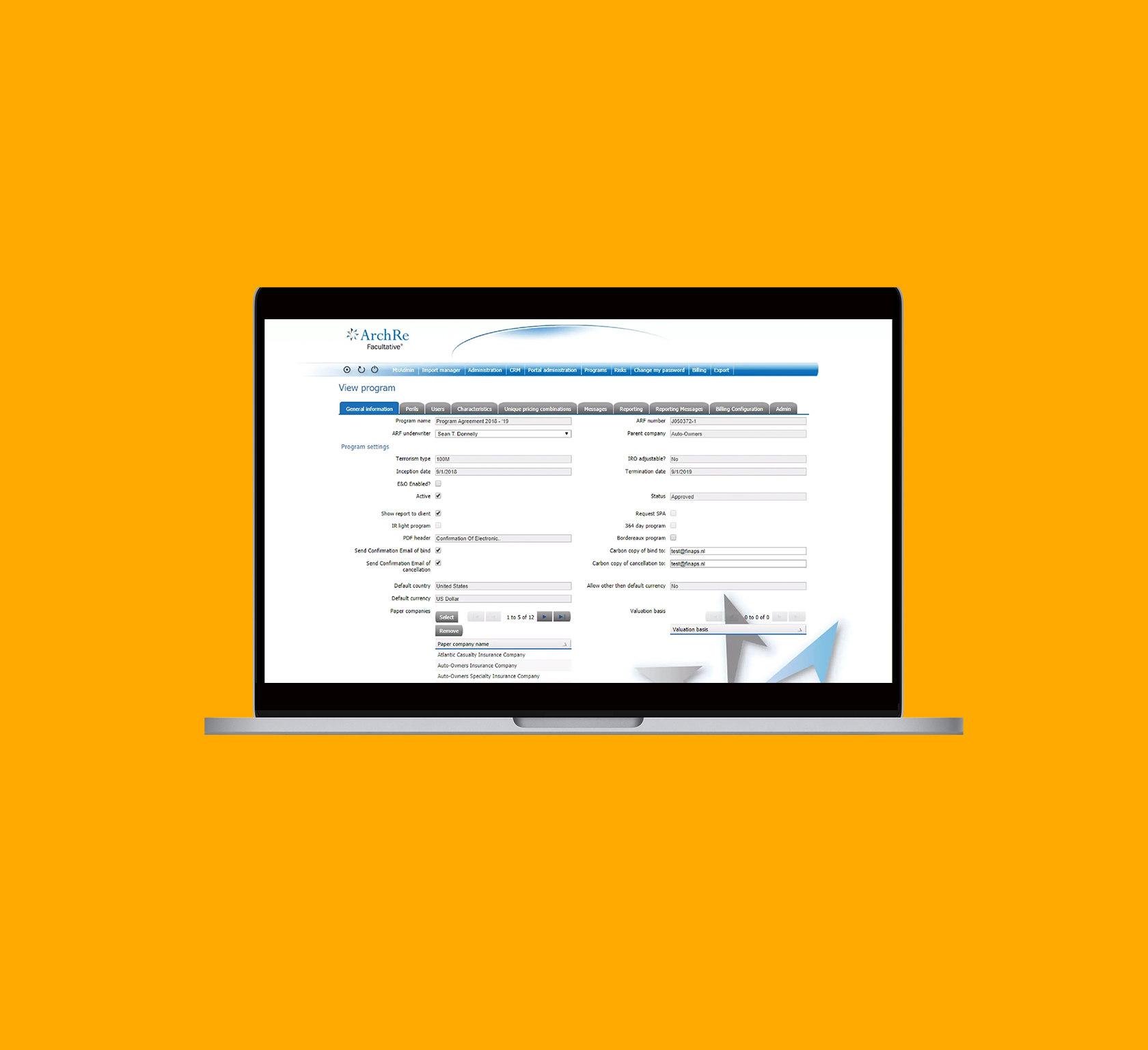

Archway allows Arch Re Fac to create new reinsurance programmes based on their clients’ unique characteristics and pricing structures. Once a programme has been created, Archway gives the respective underwriters and their managers access to an array of functions through Archway. This makes it a one-stop-shop for the management and processing of these products. Underwriters can easily submit a new risk and have the application automatically verify whether or not that risk fits the terms of the associated contract. Complex workflow rules designed by Finaps enable the team to build logic that would instantly provide pricing if the risk fits the terms of the contract, enabling a faster submission and binding process for Arch Re Fac’s clients