A highly efficient workflow offering a seamless user experience in the form of a single front-end tool for the entire Credit Risk process for Rabobank’s Wholesale banking clients. This tool offers automated data capture, enabling Rabobank to realize operational efficiency; improved data quality and faster turnaround times.

Their challenge

Challenge: Initially, writing a credit application was mostly a manual exercise, based on non-automated and non-digitalized processes. This all took place in a scattered IT landscape with few interfaces between existing data systems.

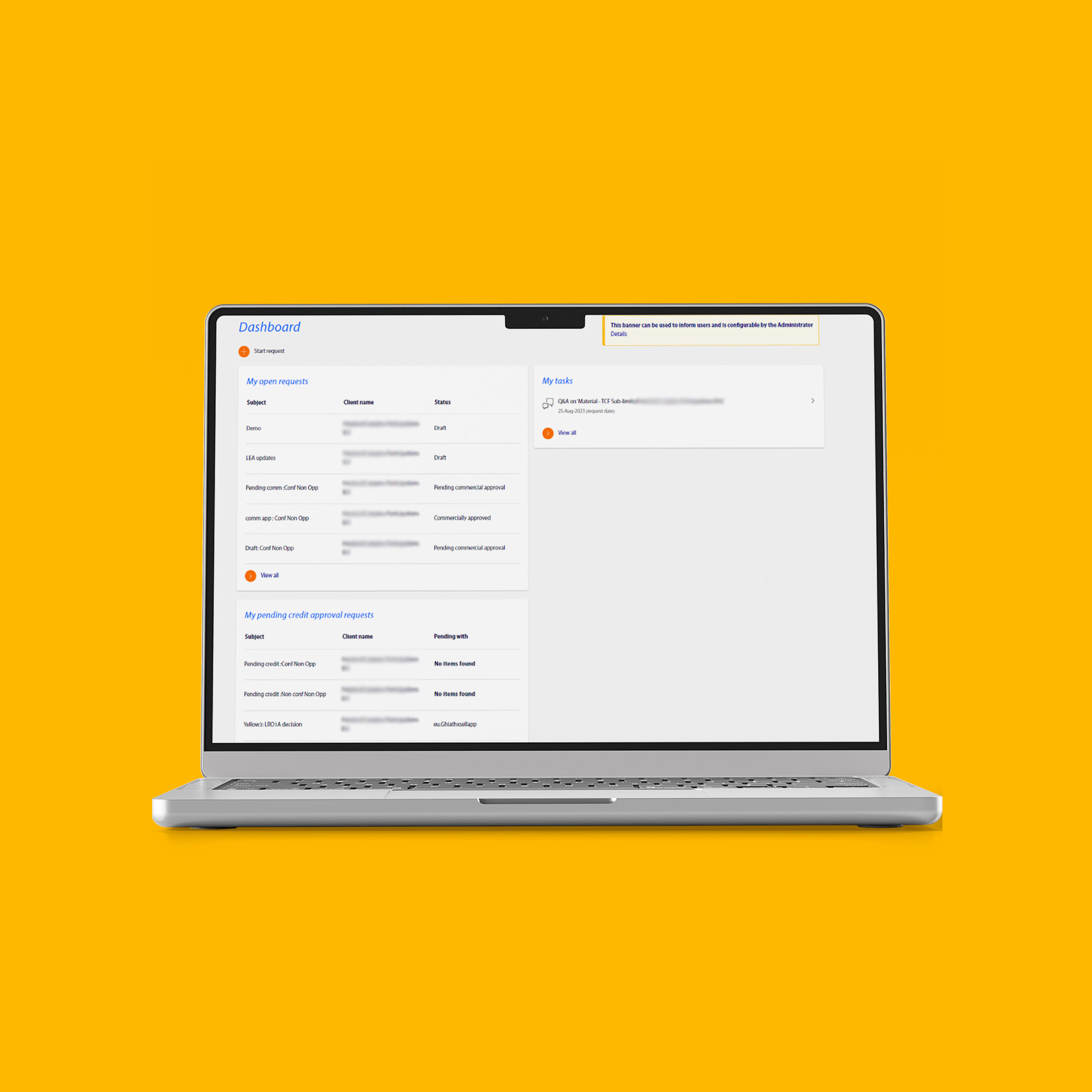

Objective: To create a single workflow tool to facilitate the entire end-to-end Wholesale Credit Risk journey (i.e., from prospecting to credit approval) globally with automated data retrieval from Rabobank’s data systems.

Target group: Business users (e.g., credit analysts, risk officers) – representing all business lines and regions around the world.

Our solution

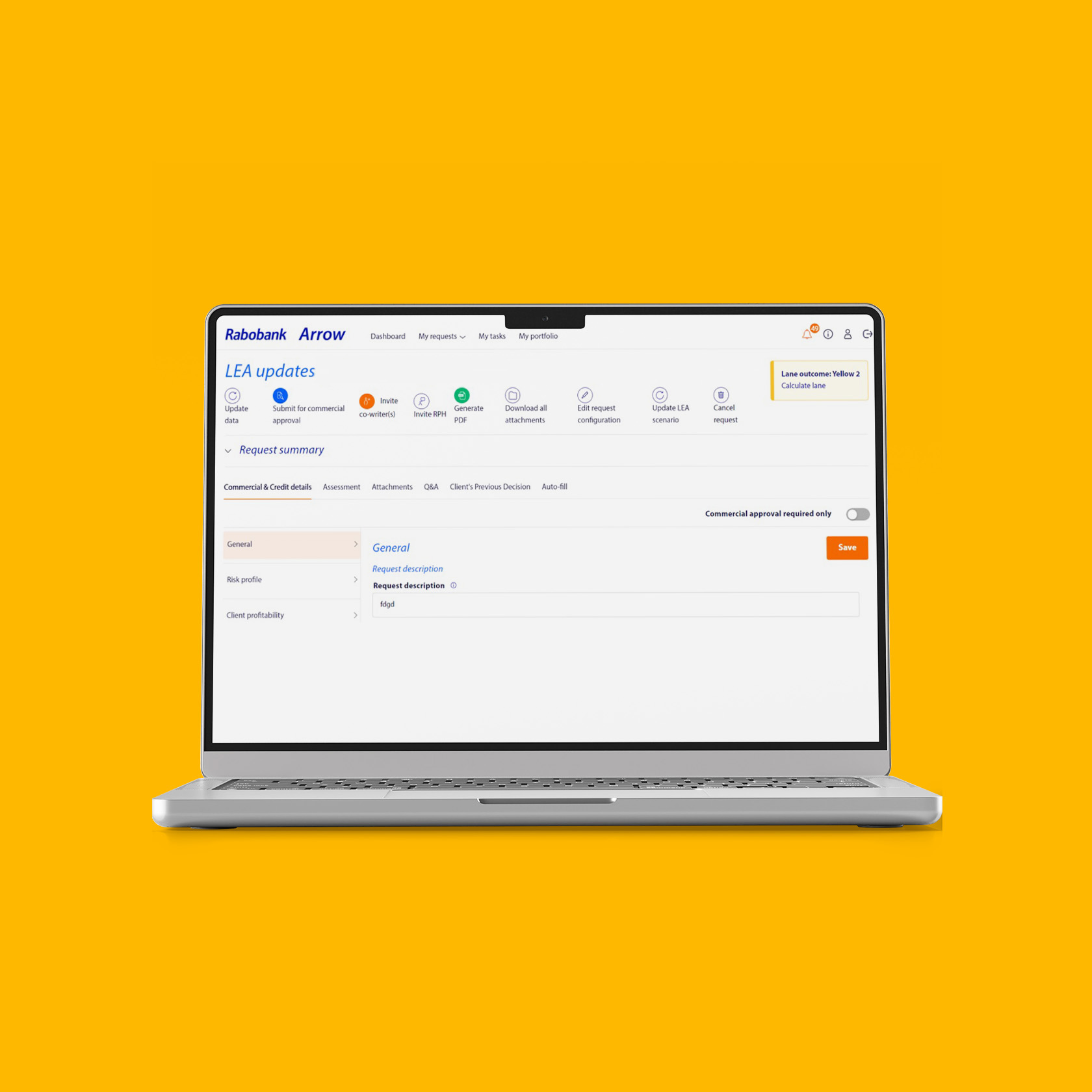

The journey towards ARROW’s initial go-live demanded intensive collaboration, involving an agile team consisting of a Rabobank product owner, an architect, business analysts, test specialists and Finaps engineers. Development of the MVP application was completed within a year and followed by a substantial second release half a year later. This extension entirely replaced a package solution with (too) many Rabobank specific customizations. Both the commercial and credit approval processes are now available within a single environment. Data enrichment is facilitated via manual input by the business users in addition to automated integrations with external data systems. Further enhancements and feature releases have continued to extend the application within Rabobank’s broader IT landscape. Continuining still to this day, with both Finaps and Rabobank engineers working hard to maintain ARROW Credit & Engagement at the highest possible standard within Wholesale Banking.

Functionalities

The application contains a diverse set of functionalities. Among the most notable is allowing business users to collaboratively write a Credit Risk Assessment report, which was achieved by integrating an extensive Rich Text Editor within the application. This tool provides highly-valued features for users, including tracked changes, commenting and locking. A more technical – but important – functionality is an additional layer of security which adds contextual data (e.g., business lines, regions, client access) obtained from an external system on top of a user’s role. This allows us to restrict access to sensitive data based upon rules determined by Compliance teams. Other notable functionalities are advanced document generation, automated e-mails and tasks, configurable stubs for testing, versioned data templates, custom made monitoring (i.e., auditing and logging) and a facilitating Q&A process between users during credit approval.

The Right Partner for Success

The benefits of working with a partner were twofold: Rabobank could leverage Finaps’ expertise to implement foundational best practices from the very start, and their internal Mendix developers could learn by co-developing alongside seasoned experts.

“Finaps has had a great impact on our success. We couldn’t have done it without them,” said Ronner. “I think what we have in common is a focus on delivery and results. Finaps was always committed to delivering and figuring things out with us, which has been key to our successful cooperation.”

Together, Finaps and Rabobank have delivered several applications over the years.