Upgrade your case management with dynamic communication workflows

From business to technology – Insights into the future of insurance – Chapter 3

Case management is a dynamic process that involves assessing, planning, executing, and monitoring activities to achieve specific outcomes. Industries like insurance and debt collection rely on it. For instance, in an accident, insurance companies determine liability and cover damages by issuing instructions and updates. However, digital transformation demands more personalized and timely communication from industries, meeting customer expectations.

Business risk

In a lot of cases communication is already automated, to a certain extend. Simple sequences of communication touch-points are configured in the software systems of the back-office. These simple sequences are applied to all cases. Making changes to the communication templates is often possible. But, changing the order of steps, introducing or removing steps, etc. requires involvement of the IT department. In many companies these systems are rigid, complex and most of the time old. It would be a miracle if your change requests are planned and handled in a timely fashion. If a change gets accepted, it can still take weeks or months before it is finally operational. And let’s just hope they got the implementation right the first time.

If this sounds familiar, you are not alone. Many companies that operate on case management face these challenges. They are held back by their outdated IT landscape.

Dynamic communication workflows

The introduction of a dynamic communication workflow engine might avoid these risks. This engine allows to define complex communication workflows, using feedback information from communication channel. The workflows can be defined by business owners, without the involvement of IT, using a visual editor.

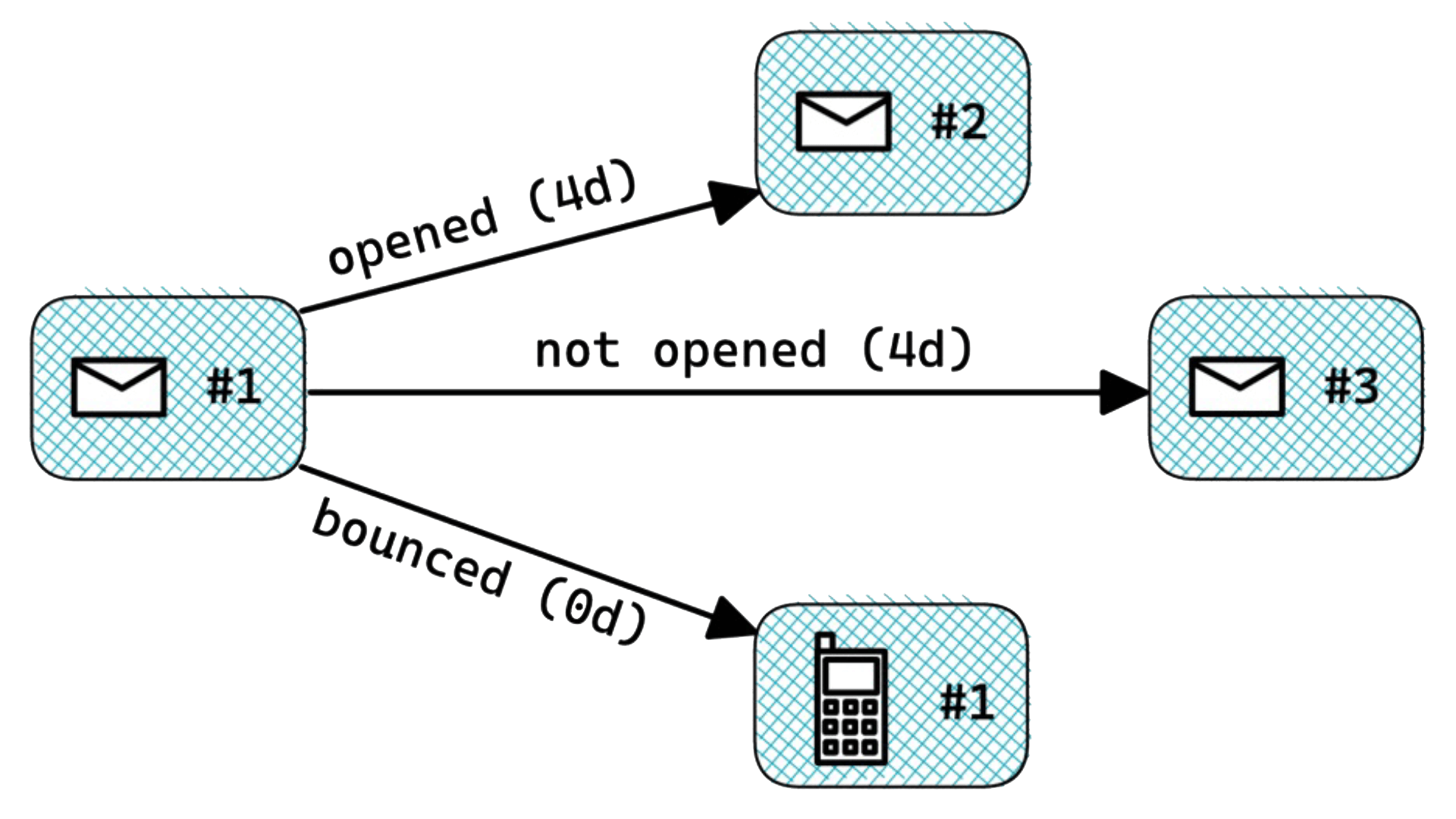

Let’s take a look at an example. What you see below is a small workflow template. The workflow starts with sending an email. The first thing we check is to see if the email bounces or not. If the email bounces, we schedule a phone call. If the email is not bounced, we wait for 4 days. After those 4 days, we check to see if the email was opened or not. Depending on this outcome, a different email is send to the recipient.

Template

This is just a template that can be configured by business owners without involvement of IT. Once a new case starts, this workflow can be triggered manually or automatically. Note that automatic triggers of new workflow have to be configured by an IT department still. But once all the automatic triggers are in place, business owners can freely update and change templates on a case-by-case basis.

Advantages

The dynamic nature of this engine is its biggest advantage for any business. It allows you to build more complex multi-channel communication strategies. By utilizing the different types of results (e.g. bounced, read, etc.) strategies can be created with higher success rates. When email bounces, you can automatically send a text message, schedule a phone call, or send a physical letter. As changes can be made real-time, without involvement of an IT department, businesses can quickly adapt and update their communication flows.

But several other advantages are paramount to for instance the insurance and debt collection industries:

- Visual representation of different communication templates and how they are connected.

- It is possible to view all past steps combined with remaining future steps in one overview. You can see the past, present, and future of a case in one go.

- The execution of the steps and their results (e.g. if the email is opened or not) are all logged. This allows you to build an accurate history of any case and create snapshots at specific times/dates.

These are advantages you get straight away, but there is more. The structured logging of events allows you to analyze the success of different strategies. This opens the door to quick A-B testing of different strategies. In addition, AI can be used to create suggestions in strategies and help increase the success rate of communication. AI can be used to automatically improve the timing and content of communication.

Who owns the process?

The biggest risk is of course loss of ownership of a (sub-)process. As processes can be changed at any given time, quality control of the processes is becoming more difficult. When everybody can just change a process, how can we be certain that each case is handled according to quality standards? The proposed solution only covers automated communication, which lowers the business risks, but there are several other ways to mitigate risks further:

- Lock workflow templates, or specific steps from changing.

- Introduce an approval mechanism before changes to workflows are put into effect.

- Ensure changes to templates are logged in the database, including the one executing/approving them. This creates an elaborate paper trail on the case level.

- Restrict who can make changes to the communication flows.

Wrapping up

Change is not without risk. This goes for introducing a new way of running automated communication flows, but also for a change in communication flows themselves. But in many industries, customers are ‘pressuring’ companies to change. Introducing a dynamic communication flow engine is a good first step for companies in creating personalized and adaptable processes without increasing the workload of their employees.

If you’re interested in learning more about what’s happening in the insurance industry and how technology is shaping its future, check out our blog series on navigating the digital transformation of the Insurance industry by clicking on the button below!