The benefits of a modern IT strategy for insurance companies

From business to technology: Insights into the future of insurance – Chapter 1

As the insurance market undergoes a significant digital transformation, customer expectations are on the rise, and regulatory bodies are enforcing more rules and restrictions. While an agile mindset and modern IT landscape can help overcome these challenges, many insurance companies still rely on outdated systems and technologies. In the face of a new digital era, failure to modernize their systems could put these companies at risk.

Embedded insurance

Let’s take the possibility of embedded insurance as an example. Creating the possibility for travel agencies to automatically include your insurance when selling plane tickets. It is an easy way to sell standardized products without the manual labor on the insurer’s end. In addition, it adds a lot of exposure of your brand to new customers. But introducing such a business opportunity means an API-gateway needs to be present on the insurer’s side. If this is non-existing, it is not possible for others to automatically request new insurances.

Many departments within an insurance company operate mostly on their own isolated system. Cross-department data is often manually inserted into different systems. This leads to an error-prone process resulting in inaccurate data. Building automated communication between outdated systems has a high risk. Old systems easily break when introducing modern solutions, and implementation will take a long time. Due to all the risks, it is safe to assume these types of projects will exceed budgets and not meet deadlines. But if it is not possible to automate connectivity between internal systems, it will also not be possible to add an API-layer to the IT landscape. The connection of the API-layer to a system is the same as between two internal systems.

But there is another hidden risk in embedded insurance. As new requests are automatically handled, KYC is ever so important to get right. KYC regulations are getting more strict as time passes. Adaption to the new regulations is difficult due to the reasons already mentioned. Even in modern software environments, making the KYC related changes takes time and is not without risk. But, as systems are often disconnected in legacy settings, inaccurate and out-of-sync data is a major risk.

Modern IT strategy

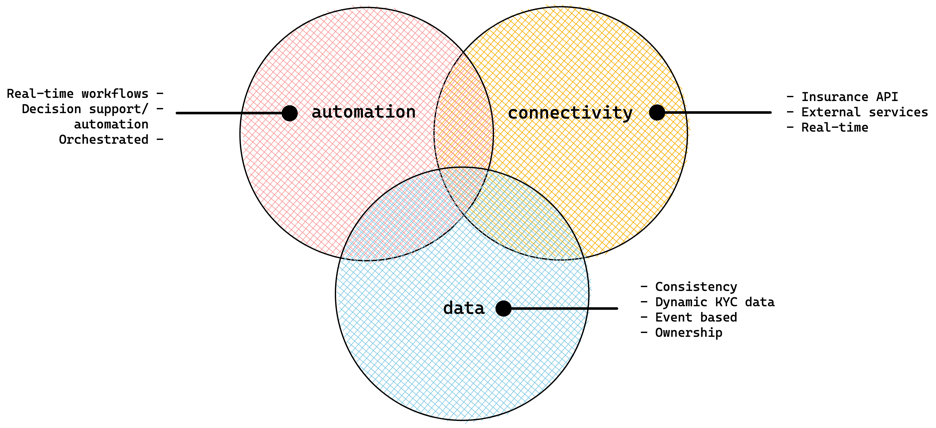

To survive and thrive in this digital transformation, a new and modern IT strategy is required. A vision that transforms an insurance company that sees IT as an enablement, instead of a cost. There are three main areas to focus on: automation, connectivity, and data.

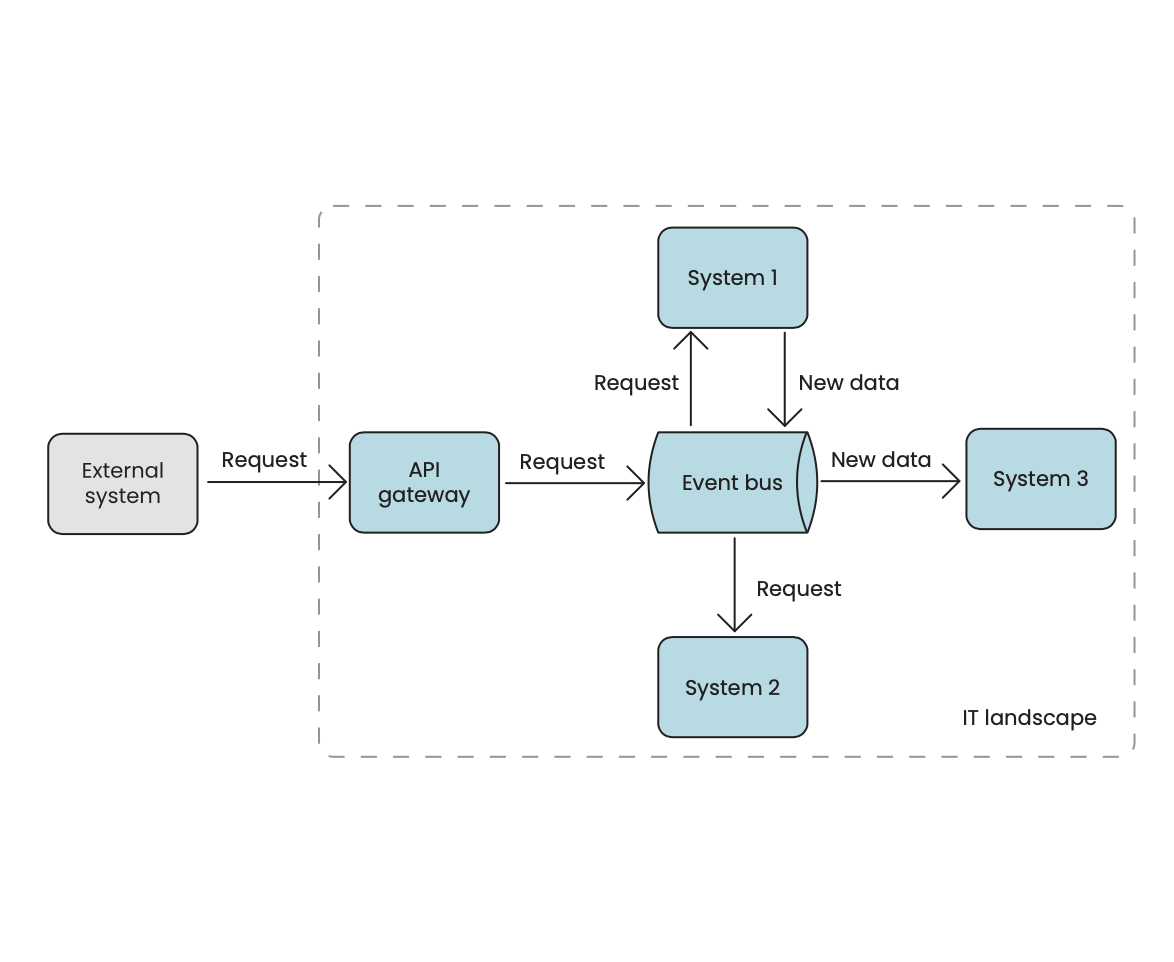

In our example of embedded insurance, connectivity and data play a vital role in the upcoming digital transformation. A common architectural vision is the introduction of an API gateway and event bus. Below is a high-level visualization of this idea. This setup allows external systems to invoke requests through the secured API gateway (e.g. embedded insurance request). The gateway (or an in-between system) sends the request via the event bus. Every other system listens to specific events here. Events that do not matter for a service are skipped. But once an event is posted that does matter a system can act upon it. In the below example, both systems 1 and 2 act upon the incoming request. Based in the request, system 1 posts a new event on the event bus. This one is picked up by system 3.

The usage of an event bus allows systems to send new data to several other systems at the same time for synchronization through workflow automation and orchestration. It facilitates event based and consistent data. In addition, it allows for real-time updates across the entire landscape. The API gateway allows external businesses to invoke requests, but also retrieve information. You become connected on the inside, and the outside. With this setup several items on our IT vision can be addressed. A big upside is you can gradually connect systems to the event bus, or replace them with modern connected alternatives.

The introduction of the API gateway is a great enabler to facilitate more modern approaches to KYC. The gateway can not only be used by other companies, but also by yourself. It allows you to build additional portals and applications (e.g., mobile apps). Small self-service portals for new customers are an accelerator in KYC. Self-service portals or mobile apps, putting the users in control, greatly helps with the accuracy of your KYC data. When combined with dynamic forms that can be configured in the back-office without changes to the IT landscape, you can become a front-runner on adaptability.

Wrapping up

A modern IT strategy allows for new business opportunities and higher adaptability to regulatory changes. When materializing the strategy, there are many roads that avoid a big bang change. They allow for a gradual and agile approach. By choosing the correct architectural approach, IT becomes an enabler and revenue driver for insurance companies, instead of necessary cost.

If you’re interested in learning more about what’s happening in the insurance industry and how technology is shaping its future, check out our blog series on navigating the digital transformation of the Insurance industry by clicking on the button below!