Real-time & dynamic pricing: the future of fair insurance premiums

From business to technology: Insights into the future of insurance – Chapter 2

The insurance industry is large and complex. It is riddled with big systems of interconnected policies and processes, supported by legacy software systems. But change is coming. The insurance industry is looking at a major digital transformation, with new start-ups focusing to disrupt their industry.

Real-time and dynamic pricing

One new idea knocking on the insurance door is real-time and dynamic pricing. It breaks away from traditional insurance policies. For instance, car insurances get cheaper if you never file a claim. But that is not a fair model for modern-day society. It does not consider if someone is an Uber driver, the amount they drive, where they drive, or even if you lost your ‘no-claim’ due to a long-lasting (private) lease agreement. Effectively it brands young drivers as high-risk.

Real-time and dynamic pricing solves this. With this method, you look at a complete picture. From static characteristics of the insured (objects) to current behavior. This draws a complete picture rather than relying on dated and incomplete data. In our car insurance example, we can base the price on the actual car, the condition of the car, how well it is maintained, or the amount driven. In addition, we can also look at where the insured lives and see this person’s driving frequency. These data points can aid the decision-making process with considerations such as certain types of claims are more common in cities compared to those in more rural areas.

This creates a tailored policy for each insured with a fair premium against the risk they have. The lower your risk, the lower your costs. With real-time and dynamic pricing insured get fair but flexible premiums. For insurance companies risks are mitigated to the same level as before.

Bussines complexity

Most insurance policies are a complex web of rules. They consider every edge case. Large property insurance, for example, can have different pricing layers, based on various characteristics. Based on the total insured value, the premium becomes the sum of different layers. But pricing layers can also be used to change the outcome of incoming claims, based on their characteristics. It is not uncommon for certain insurances to allow for endorsements. These change the policy agreements and premiums starting from a specified date.

Capturing all these policy characteristics and determining a fair premium is complex. But navigating them when approving claims is equally complex. The complexity of approving claims increases when moving from generic policies toward tailored ones. When not supported by decision automation or support systems, insurance companies are exposed to major risks.

Technical solution

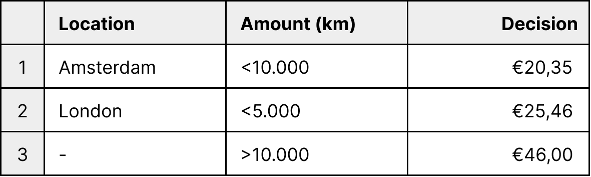

By introducing modern software solutions, insurance companies can introduce automated real-time and dynamic pricing. The most common approach is to introduce a decision engine. Decision engines allow businesses to make automated complex decisions. When executed manually, complex decisions often represent a decision tree. At each step in the tree, we check another part of the data to determine what branch we should follow. A decision engine allows us to automate these types of decisions based on decision tables, as visualized below.

A decision table is a different representation of the decision tree. Each column represents a data element that can be used to evaluate. Each rule combines one or more data elements that combined result in an output, or decision. The decision engine allows us to evaluate cases against all the rules at once. In contrast with decision trees, decision tables allow for overlapping rules for a given case. Depending on the hit-policy of the table, the actual decision might differ. We can choose to comply with the “top rule” or aggregate all rules together. In the example table, an insured driving more than 10.000 km must pay the sum of rules 1 and 3 as the premium.

“By introducing modern software solutions, insurance companies can introduce automated real-time and dynamic pricing.”

Decision tables have many advantages for the insurance industry:

- Overlapping rules allow us to configure pricing layers in a single table.

- Overlapping or conflicting rules can be highlighted on configuration.

- The output of one decision table can be used as input for another, combining the two tables basically. This allows for more complex rule structures.

- The structured setup allows for AI to automatically update or create rules based on real-time data.

- You can model the outcome towards manual evaluation.

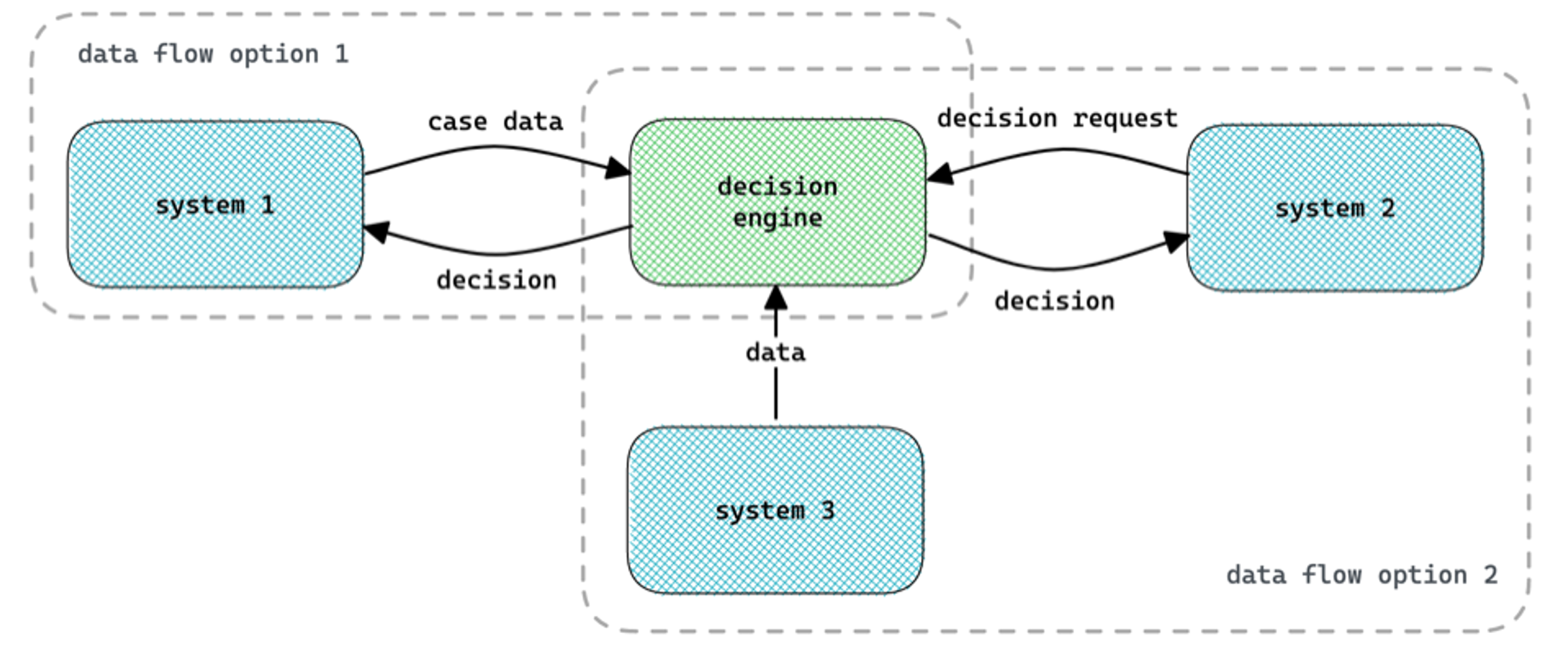

The IT landscape of most insurance companies is often complex. It often consists of multiple applications and systems working together. As a decision engine can be used in different parts of the insurance process, it should not be encapsulated into a single application. In addition, data required to make decisions is often an aggregation of data coming from various systems.

Depending on the capabilities within the existing IT landscape, data can flow in various ways. A system can send all case-related data to the engine, or the engine can retrieve all relevant data from different sources (ideally from a data warehouse). Combined with the use of a standard notation of decision tables a future-proof solution is created.

Wrapping up

A centralized decision engine created the possibility for insurance companies to move toward real-time and dynamic pricing models. It allows you to create tailored policies with fair premiums, without additional risks for insurance companies. But it also enables other parts of the insurance process to automate decisions.