SusPens Hackathon 2021: Winner Fast Award

How Dutch Pension funds can rapidly innovate and adapt

On the 20th of January the Finaps Hackathon team participated in a one-day Hackathon, organized by the KPS – Kring van Pensioen Specialisten (association of Pension Specialists in the Netherlands) cooperating with Achmea and Athora. A one-day hackathon, you may ask? Normally Hackathons last for 24 to 48 hours and include a lot of caffeine, candy and pizza. Although this one was different it was evenly intense and fun.

Date: 01-2021

The challenge of this Hackathon

Let’s jump into the case. Imagine this: you are retired, and you get the opportunity to retrieve 10% of your pension income at once. This is becoming reality in the near future. The Dutch pension world is facing quite a fundamental change: in 2023 it will be possible to retrieve 10% of your saved pension sum in one go – the lumpsum.

Comparable pension structures are known across Europe. However, this is a new step for the Netherlands and causes many complex questions for new pensioner:

– Can I take the money to travel the world?

– What impact does that have on the monthly payments for the rest of my life?

– How much risk am I willing to accept?

– Do I have more profitable investment options? And what about taxes?

All these questions lead to the key question:

How can we transform these topics that are normally considered too complicated, stressful or even boring to questions that people want to answer, in an easy, approachable and even fun way?

To make it even harder. The solution has to respect the duty of the pension fund to inform but not to advise.

Finaps decided to participate in the Hackathon because this question is both new as well as complex and is demanding a full focus on properly informing beneficiaries, the future pensioners. This was our starting point to develop not only a roadmap to a solution but also implement the first ideas into a prototype during this day.

Race against time

Supported by the organizers of the Hackathon and KPS we were able to learn about this complex topic in a short amount of time and clarify essential questions about its background beforehand. Due to this we were already able to form a vision about a potential solution that enabled us to get right started on the big day.

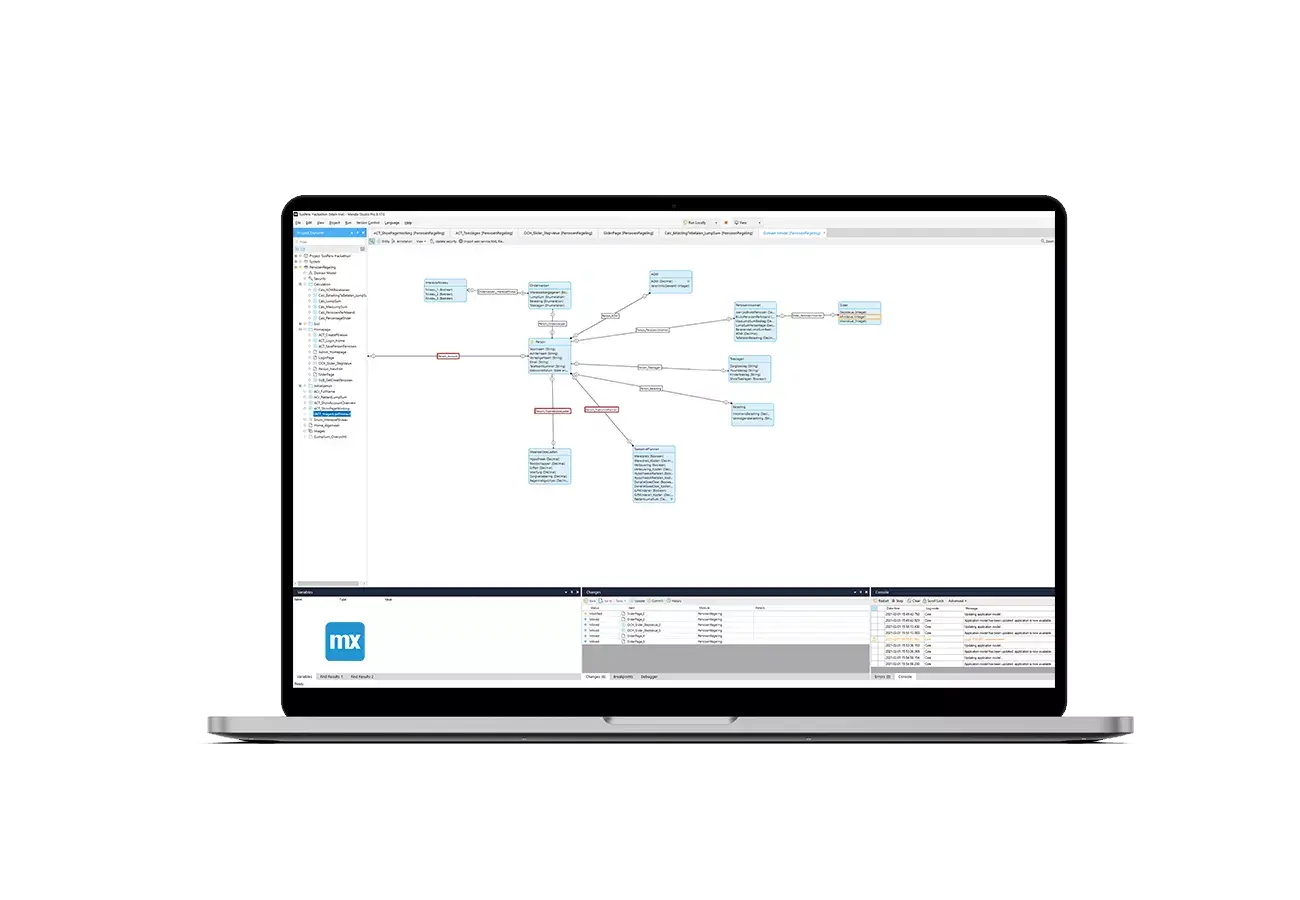

During a hectic day we combined the overall vision, the view of the potential user as well as accurate calculation models in a first working prototype. Discussions, iterations and technical challenges were overcome.

And stop the clock!

Miraculously everything came together at the exact right moment. We were ready to virtually pitch and demo our results in front of the Jury.

Our pitch

We created a three-layered information web portal, that displays information gradually, in an understandable way, spiced up with some gamification aspects.

Our primary goal was to motivate everyone, who has to make the choice about the lumpsum, to understand the overall impact this has on monthly pension payments in the future. Guided in a user-friendly way, users can digitally follow a path that gradually displays more and more relevant factors such as taxes, allowances, and even past spending patterns. In the end, each user has a comprehensive picture of his future income and how these factors affect the choice to take/or not take up such a one-off sum. Needless to say that privacy and data were taken into consideration when designing the architecture of the solution.

We showed our prototype to the jury and it is safe to say that the pitch became one for the history books. We were confident, however the other teams still had to tell their story.

And the winner is…

After hearing the pitches of the other teams, adrenaline came back rushing in when we were announced winner of the fast award – the prototype that was most ready to be brought to production and to be implemented by the industry! Great news.