Is your organisation

truly data-driven?

Many organisations might think that simply because they have collected data, generate a lot of reports and use fancy dashboards, they are data-driven. However, to be truly data-driven you need prescriptive analytics, then seriously consider these findings before acting upon them.

09-2019

Signs that your organisation is not data-driven

Having big data or a team of unicorn data scientists, does not immediately make an organisation data-driven. It requires establishing an effective and deeply ingrained data-driven mindset.

It is often the last step in the process of extracting value from data, the decision-making itself, that is least discussed. You can have skilled analysts who generate masterful reports and present carefully crafted insights and recommendations. However, if that report sits on a desk, or unopened in an inbox, then it is all for nothing.

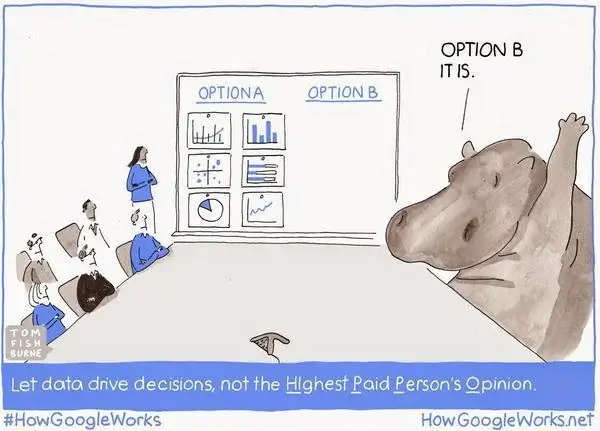

Culture too, is key. It is important for your organisation to go against the so-called HiPPO-culture (Source: Agile & Entrepreneurship Best Articles). This is a culture where the Highest Paid Person’s Opinion (HiPPO) influences all decisions. The danger exists that the HiPPO has already made up his mind what action he’s going to take, regardless of what the data shows. An organisation with such a culture will never be data-driven.

Setup for failure

There are several types of activities that data-driven organisations engage in.

These activities help complete the full analytics value chain. It requires that the right data is collected, the analysis is properly conducted, the insights are carefully considered, and that the correct concrete actions are performed. Furthermore, acceptance among employees and their trust in data is needed to change from a HiPPO-culture to one that trusts data.

The culture in a data-driven organisation should be one of continuous improvement. Rather than let the HiPPO-culture take over, everyone strives to be able to make better decisions every day. An organisation with such a culture is constantly considering different scenarios using A/B-tests to determine the best course of action. Finally, they choose among future options or actions using a suite of weighted variables, often obtained from (predictive) analytics on the data.

ING’s Asset Based Finance strives to be such an organisation. By talking to everyone – from higher management to employees – about the possibilities of data, they strive to make the organisation data-driven. Using a three-phase process – from proof of concept, to pilot, to production – it is possible to show the added value of data-driven solutions to the business.

Becoming data-driven, step by step

It is always possible to have a better decision-making process. The first step is to ask: “How do I make decisions?”. Are you the HiPPO, or do you trust data? Do you follow your gut feeling, or take all data into account? The next step is to ask: “How does the organisation make decisions?”. Only when everyone in the organisation trusts the power of data-driven decisions, you’re ready for the next step – act upon all the derived insights. Your organisation must become truly data-driven. It doesn’t have to be today, or tomorrow, but it is a prerequisite for a futureproof organisation.

Being data-driven is

a spectrum: it is not binary

– you can always become

more data-driven

Conclusion

It is difficult to become a data-driven organisation by yourself. This is why ING Asset Based Finance tries to help their customers become more data-driven as well and is regularly piloting new services. They always strive to use the newest technologies and developments in data analytics, machine learning and A.I. For example, they provide a tool for their clients that uses A.I. to predict changes in their working capital. Both parties – ING and the client – are notified in changes with respect to the payment behaviour of their debtors. This not only informs them, it enables them to take action on these debtors. A win-win situation, where both parties become more data-driven.